What is a Trust and Do I need one?

- Trusts are a legal construct that allows you to create a separate legal entity to hold your assets in order to avoid probate and accomplish tax, asset protection, delayed inheritances, guardianship court avoidance, and other financial goals. A trust basically allows a person to transfer assets out of their name, but still retain control and management of their property. Trusts avoid probate because assets in a trust are not in a deceased person's name; and therefore do not need court involvement to be transferred to living beneficiaries. Trusts that are properly funded are the ONLY WAY to avoid the costly, public, and time-consuming probate process.

Trust Benefits:

- Trusts that are properly funded are the ONLY WAY to avoid the costly, public, and time-consuming probate process

- Totally private and family controlled

- No court control, no probate court, no guardianship court

- No delays

- No hassles

- Trusts accomplish a tremendous amount of legal, tax, personal, family, asset protection, and other goals such as:

- Provide care, funding, and direction for YOU and YOUR LOVED ONES, in the event of sickness and disability.

- Bridge the gap between life and death by continuing to care for your family after your death.

- Protect assets from creditors malpractice claimants, and divorce actions

- Can manage businesses, real estate, or other assets

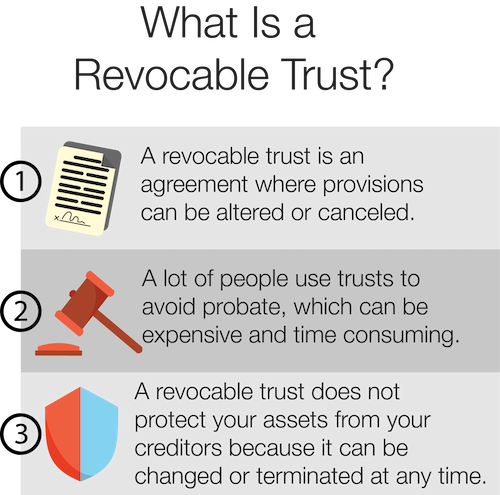

When a valid trust is created, assets are taken out of an individual's name, and held in the trust's name instead. Revocable living trusts are the most common type of trust due to its flexibility and how easy it is to create and fund. Creating a trust is not difficult and just requires some paperwork to be done by a trained lawyer. A revocable living trust is created and funded during a person's lifetime. Revocable living trusts can be updated and changed very easily and are good for a lifetime-- even if your wishes, beneficiaries, and state of residence changes!

A testamentary trust is created after your death by a provision in your will. These types of trusts are also very common in estate planning. The type of trust used is dependent on your specific goals and circumstances. Testamentary trusts do have to go through the probate process, and are not usually recommended for people who have beneficiaries who would need immediate access to the money.

Find The Option That's Right For Your Family

The best way for you to determine whether or not your estate plan should include a will, a living trust, or some combination of the two is to meet with us as your Personal Family Lawyer® for a Family Wealth Planning Session™. During this process, we'll take you through an analysis of your assets, what's most important to you, and what will happen to your loved ones when you become incapacitated or die.

Sitting down with us, your Personal Family Lawyer® will empower you to feel 100% confident that you have the right combination of estate planning solutions to fit with your unique asset profile, family dynamics, and budget. Schedule your appointment today to get started.

Contact us today to receive your free estate planning consultation!